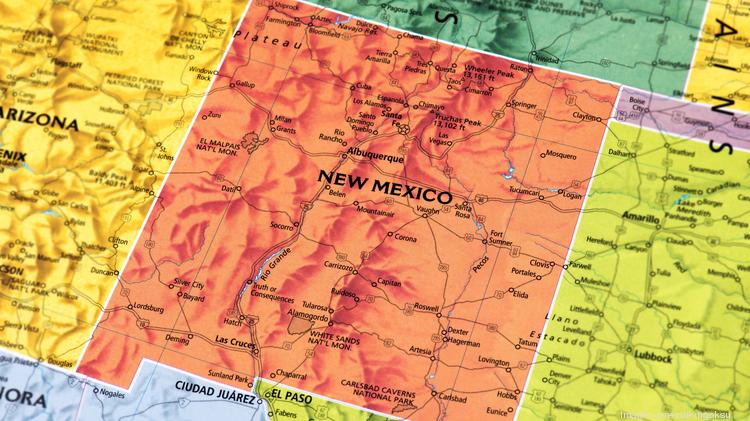

New Mexico has about a 5.13 percent state tax rate and an average local tax rate of 2.43 percent. But how does that compare to other states?

The Tax Foundation did a study to analyze states' sales taxes and found New Mexico had the 15th highest combined rate of taxes.

The Tax Foundation study looked at those retail sales taxes and local sales taxes to calculate a population-weighted average of local sales taxes as of Jan 1. The Tax Foundation conducted the study by weighing the Sales Tax Clearinghouse quarterly sales tax data according to Census 2010 population figures.

New Mexico is one of 38 states that have local sales taxes with an average local tax rate is 2.43 percent. Alabama has the highest average local sales tax rates — 5.01 percent. Louisiana had the second highest with 4.98 percent. New Mexico's neighbor, Colorado, had the third highest rate of 4.6 percent. Technically the state collects gross receipts tax.

Among the states with the lowest local tax were Idaho with .03 percent and Mississippi with .07 percent. Click here to read the full article.

Comments