A New Mexico businessman claimed to help low-income Spanish-speaking families by finding them foreclosed homes to buy and, in some cases, financing the deals.

Mr. Cano and his firm, JSS, were sued by the New Mexico attorney general in state court, alleging that his real estate and home financing activities revealed a pattern of “unfair and deceptive trade practices and unconscionable trade practices.”

Officials indicated other parties could be added later to the civil complaint, which seeks restitution and civil penalties.

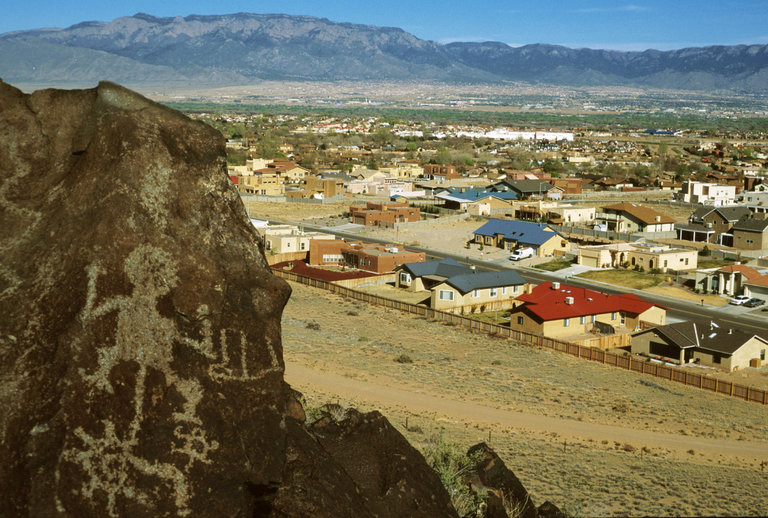

This year, officials began investigating complaints about seller-financed home sales aimed at immigrant and Spanish-speaking communities. New Mexico is one of more than a dozen states where investment firms have bought decrepit homes in the aftermath of the foreclosure crisis and resold them to low-income families through either long-term installment deals called contracts for deed, or rent-to-own transactions.

“Families everywhere struggling to afford a home need to be aware that real estate contracts do not provide the same protections offered by a mortgage,” Hector H. Balderas, New Mexico’s attorney general, said in a statement.

“They should know that, among other things, a buyer who defaults on a seller-financed real estate contract could face imminent eviction and lose all of the payments made on the property,” he added.

Seller-financed deals can provide an alternative to families who want to own a home but cannot get a mortgage because of poor credit or an unwillingness of banks to write loans for under $100,000. But the transactions often lack basic consumer protections and have begun to draw scrutiny from the federal Consumer Financial Protection Bureau and state regulators.

The investigations were prompted in part by a series of articles in The New York Times on the revival of seller-financed home deals. Click here to read the full article.

Comments