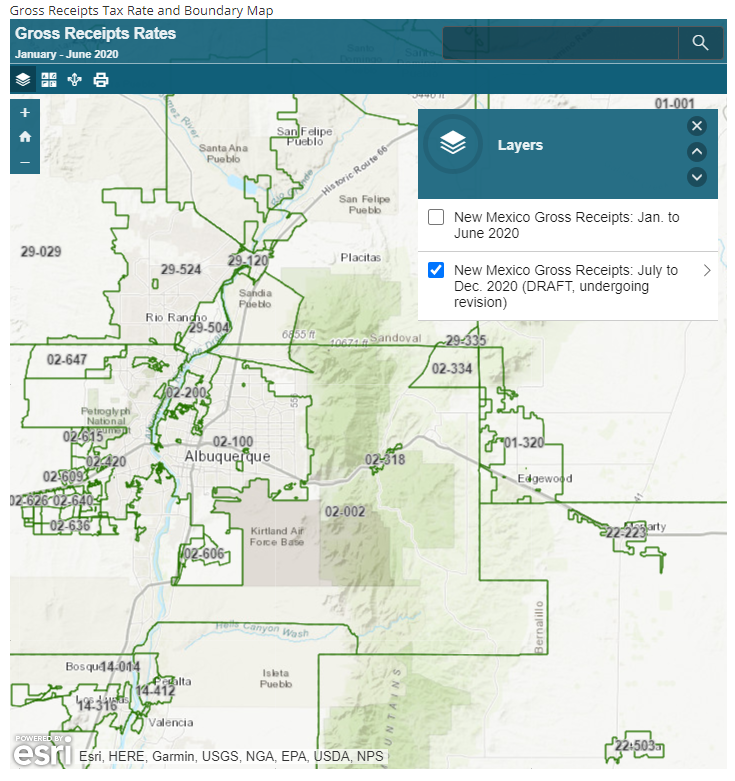

The Gross Receipts Tax Rate Schedule and Boundary Map, provided by the NM Taxation and Revenue Department has been updated for July 1, 2020, and is now current through December 31, 2020.

SWMLS users are able to access a GRT Map Overlay within the Map screen of the Quick Search. This GRT Overlay map is important for auto-populating the GRT code value on new listings entered in the MLS. SWMLS REALTORS with an On Market listing should review their GRT code information for accuracy, and if necessary change it to the updated value. As of July 7, 2020, the FlexMLS contains the current GRT version for July 2020-December 2020.

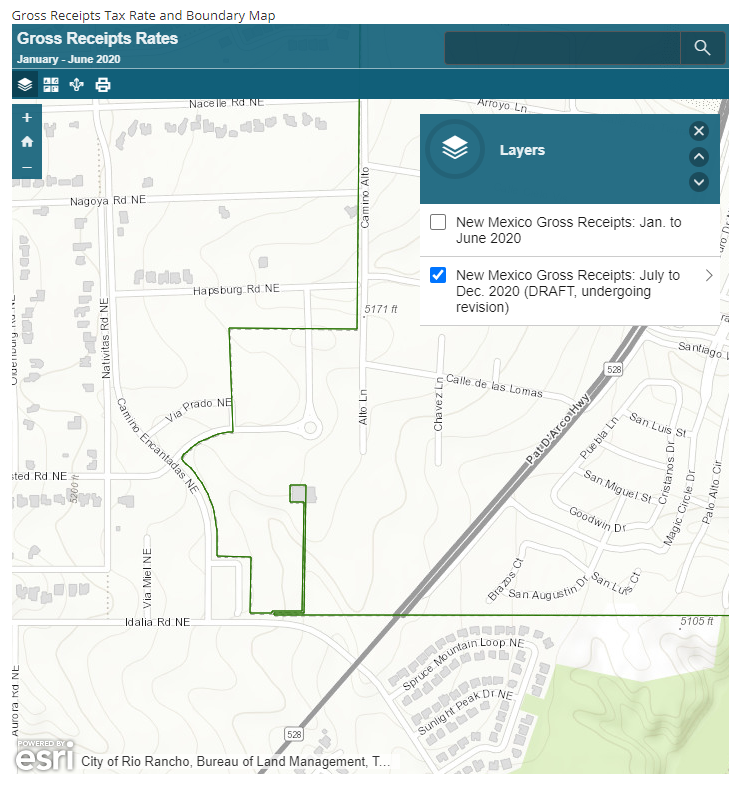

For the July 2020 – December 2020 GRT update, there were some rate changes and minor changes to GRT boundaries in the state . For the latest version, SWMLS identified a GRT boundary adjustment in Rio Rancho (near Highway 528 and Idalia). Listings in this section of Rio Rancho are advised to revise their GRT code after July 1.

Listed below, are questions and answers that have been collected over the years since GRT was implemented in SWMLS.

Buyer’s Broker

Q: Why is the GRT Code a required field on the MLS?

A: The GRT Code has been programmed to auto-populate the correct tax code on the MLS Detail Report to provide to the buyer's broker to enter on the Purchase Agreement.

Q: Why is it important to include the GRT Code on the Purchase Agreement?

A: It is important to enter the correct GRT Code on the Purchase Agreement to inform the title company of the correct tax code so they can verify the current gross receipts tax rate for that particular address. There are several properties in the metropolitan area that are located in “Albuquerque”, however, the property may be located within a county pocket, therefore, the tax code and gross receipts tax rate will be different from the Albuquerque tax rate.

Q: How can a buyer’s broker verify whether the Tax Code is correct?

A: A broker can verify the Tax Code and GRT Rate by clicking the link further down, to access the GRT Boundary Map on the NM Taxation & Revenue website. If the Tax Code on the NM Taxation & Revenue website is different from Tax Code on the MLS Detail Report, this could be due to the Listing Broker not updating the listing’s GRT Code when the property’s boundary was revised.

The other tool a broker could use to verify the Tax Code is by clicking on the “Overlays” and select GRT Location Code. This provides a map of all GRT boundaries throughout the state, accessible directly in the MLS!

Q: If a property has an Albuquerque address, wouldn’t the Tax Code be the Albuquerque Tax Code 02-100?

A: No. There are different boundaries located within the metropolitan area. If a property is located in a different boundary, such as county, the Tax Code and GRT Rate will be under “Remainder of County” on the Tax Schedule. The Tax Schedule is broken down by each county for the state.

The link to the NM Taxation & Revnue website is the best resource to verify the correct Tax Code and GRT Rate, as there are many different Tax Codes that are based on the municipality or county in which the property is located in.

Listing Broker

Q: Why is the GRT Code and Tax Rate important to Listing Brokers?

A: The GRT Code and Tax Rate is important for Listing Brokers to know to complete a Net Sheet for their seller. Net Sheets provide sellers an approximate breakdown of closing fees to inform sellers how much they will be receiving or owing at Closing.

Since most transactions involve passing the Gross Receipts Tax onto the seller, it is important to know how to verify that the Net Sheet is auto-populating the correct amount that will be deducted from the seller’s proceeds at Closing. If you are using a manual Net Sheet that does not auto-populate, the Listing Broker should know the correct Tax Rate to add to the fees that will be debited from the Seller’s proceeds (example below):

Ex: Sales price $200,000 x 6% commission rate = $12,000.00 commission; $12,000.00 x 7.875% (ABQ tax rate) = $945.00 Gross Receipts

The amount that should be entered on this seller’s Net Sheet, should be $12,000 plus $945.00. However, if the property is located in a county pocket, the Gross Receipts should be $772.50 since the tax rate for Bernalillo County is 6.4375%.

The seller’s Settlement Statement would be broken as follows:

- The total check due to the Listing Office will be $6000 + $472.50 = $6472.50

- The total check due to the Selling Office will be $6000 + $472.50 = $6472.50

*If the property is located in a county pocket, the total check due to each side will be $6000 +$386.25 = $6386.25

Q: Is the Listing Broker required to manually enter the Tax Code when entering the listing information?

A: No. The GRT Code is auto-populated based on the mapped location of the property. Once mapping has been verified by the MLS User when entering the listing, the GRT Code will auto-populate into the property details, under “GRT Code”. Once the listing is completed, the GRT Code will be located in the County Data box on the MLS Detail Report

Q: The MLS Detail Report provides the Tax Code, but, how do I verify the GRT rate prior to the property being listed in order to provide a seller with a Net Sheet with the correct GRT rate?

A: To obtain the current GRT rate, click on, or cut and paste the following link: http://www.tax.newmexico.gov/gross-receipts-tax-historic-rates.aspx. This link will take you directly to the Gross Receipts Boundary Map on the NM TRD website.

Comments