By Ken Fears:

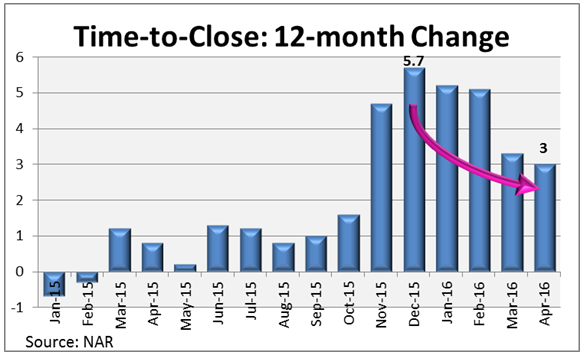

The average delay in time-to-close fell in April, marking the 4th consecutive month of improvement.

On average, sales that closed in April took 3 days longer than the same time a year earlier. April’s reading is down from a peak delay of 5.7 days in December of 2015.

Since last December the average time-to-close a home sale compared to the same month a year earlier, a means of adjusting for seasonal patterns, has fallen suggesting that TRID-related delays continue to ease. Delays remain nearly three times their pre-TRID level and concentrated in a small portion of the market.

TRID or Know Before You Owe is a new set of rules governing the closing process. These rules are intended to help make consumers more aware of their liability, while streamlining the process. Delays are likely to continue to ease as successful originators gain market share and with improvements in vendor software. The CFPB recently announced that it will address some of the issues raised about Know Before You Owe later this year.

About the Author

Ken Fears is the Manager of Regional Economics and Housing Finance Policy. He focuses on regional and local market trends found in the Local Market Reports and the Market Watch Reports . He also writes on developments in the mortgage industry and foreclosures.

Click here for more articles on NAR's Economists Outlook Blog

Comments